Prepaid Rent and Other Rent Accounting for ASC 842 Explained

Perform pre-consolidation, group-level analysis in real-time with efficient, end-to-end transparency and traceability. Reduce risk and save time by automating workflows to provide more timely insights. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

These expenses are initially documented as an asset on the firm’s balance sheet, and as its benefits are eventually realised over time, they would then be classified as an expense. – Once the expense has been incurred and the asset is realised, an entry can then be made to the profit and loss statement’s expense account, whilst the balance sheet’s prepaid asset account may be deducted equally. Then, when the expense is incurred, the prepaid expense account is reduced by the amount of the expense, and the expense is recognized on the company’s income statement in the period when it was incurred.

prepaid rent definition

Meanwhile, some companies pay taxes before they are due, such as an estimated tax payment based on what might come due in the future. Other less common prepaid expenses might include equipment rental or utilities. Under Prepaid Rent Accounting the cash basis system, the expenses and revenues are not recorded until the cash element is included. Therefore, the prepaid expenses are recorded as debit of cash, and receiving unearned revenue is a credit of cash.

- By requiring tenants to pay rent in advance, landlords can ensure that they will receive rental income even if the tenant defaults on the lease or vacates the property before the end of the lease term.

- According to the accounting debit and credit rules, all assets and expense accounts are debit entries.

- However, when the services are taken during the rental period, the prepaid rent is credited, and the rent expense will be debited.

- In that case, the amount of rent for one month will be subtracted from the prepaid rent recorded on the balance sheet.

- Under the cash basis system, the expenses and revenues are not recorded until the cash element is included.

- At the end of the lease term, the prepaid rent asset account should have a zero balance, as you should have applied all of the prepaid rent to rent expenses.

The purpose of prepaid rent is to provide financial security for landlords. By requiring tenants to pay rent in advance, landlords can ensure that they will receive rental income even if the tenant defaults on the lease or vacates the property before the end of the lease term. For both the legacy and new lease accounting standards, the timing of the rent payment being known is the triggering event. For example, let’s examine a lease agreement that includes a variable rent portion of a percentage of sales over an annual minimum. At the initial measurement and recognition of the lease, the company is unsure if or when the minimum threshold will be exceeded. Therefore the variable portion of the rent payment is not included in the initial calculations, only expensed in the period paid.

What is Accounts Receivable Collection Period? (Definition, Formula, and Example)

It could be owned by an individual, corporation, or country with the expectation that it will yield future benefits. On a company’s balance sheet, assets are classified as current, fixed, financial, and intangible assets. A company usually purchases or creates an asset to increase its business value or benefit the business’s operations.

- Without accurate information, organizations risk making poor business decisions, paying too much, issuing inaccurate financial statements, and other errors.

- Prepaid rent is not initially recorded on an income statement in accordance with the Generally Accepted Accounting Principles (GAAP), and as such are not temporary accounts.

- A legalretainer is often required before a lawyer or firm will begin representation.

- Automatically identify intercompany exceptions and underlying transactions causing out-of-balances with rules-based solutions to resolve discrepancies quickly.

- BlackLine solutions address the traditional manual processes that are performed by accountants outside the ERP, often in spreadsheets.

- Prepaid rent, prepaid insurance, utility bills, interest, etc., are an entity’s most common prepaid expenses.

Then, for every month of this one-year policy, the firm will need to note down US$1,000 in expenses within its profit and loss statement, followed by drawing down the prepaid asset in the balance sheet by the same amount. Regardless of whether it’s insurance, rent, utilities, or any other expense that’s paid in advance, it should be recorded in the appropriate prepaid asset account. In the accrual basis of accounting, prepaid expenses’ payment is recorded as an increase of prepaid rent in current assets. This results in a problem with prepaid expenses for the entities following the accrual system of accounting.

Record the initial payment

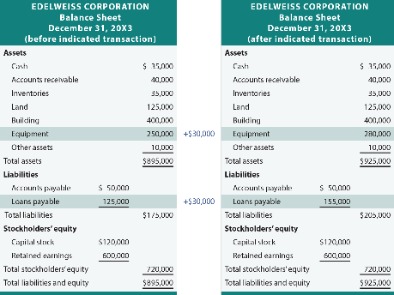

Keep in mind however, rent or lease expenses are related to operating leases only. If an entity has a capital or finance lease, payments reduce the capital lease liability and accrued interest, and are therefore, not recorded to rent or lease expense. When rent is paid in advance of its due date, prepaid rent is recorded at the time of payment as a credit to cash/accounts payable and a debit to prepaid rent. When the future rent period occurs, the prepaid is relieved to rent expense with a credit to prepaid rent and a debit to rent expense. Prepaid rent—a lease payment made for a future period—is another common example of a prepaid expense. An organization makes a cash payment to the leasing company, but the rent expense has not yet been incurred, so the company must record the prepaid rent.

Is prepaid rent an asset or expense?

Prepaid rent is recorded as an asset on the balance sheet and is initially recognized when you pay. As the period covered by the prepaid rent payment occurs, you decrease the prepaid rent asset account and increase the rent expense account.

This company-wide effort crosses multiple functional areas and is reinforced by critical project management and a strong technology infrastructure. Retailers are recalibrating their strategies and investing in innovative business models to drive transformation quickly, profitably, and at scale. Save time, reduce risk, and create capacity to support your organization’s strategic objectives.

Accounting For Prepaid Rent

Base rent, also known as fixed rent, is the portion of the rent payment explicitly stated in the contract. A leasing contract may include a payment schedule of the expected annual or monthly payments. Even if the contract includes escalation increments to the beginning or base payment https://kelleysbookkeeping.com/what-is-the-materials-usage-variance/ amount, this type of rent is fixed. It is presented in the contract, along with planned increases, and will not change over the contract term without an amendment. BlackLine Journal Entry is a full journal entry management system that integrates with BlackLine Account Reconciliations.

Is rent receivable prepaid an asset?

The accrued rent receivable account is considered a current asset, since rent is typically due within the next year. A landlord could offset this receivable with an allowance for doubtful accounts, if there is a probability that a tenant will not pay rent.

Even though a company makes a cash payment to the leasing company, the rent expense has not yet been incurred and therefore has to be recorded on the balance sheet as prepaid rent. Hence, prepaid rent is a current asset because the amount paid in advance can be used in the future to reduce rent expenses when incurred. An asset is something that provides a current, future, or potential economic benefit for a company. Hence, an advance payment of rent is a typical example of an asset because it provides a future economic benefit to the company by reducing rent expenses when incurred. Therefore, prepaid rent is reported on the balance sheet as a current asset account that will be expensed at some point in the future. A business will record prepaid rent as an asset on the balance sheet because it represents a future benefit due to the business.